![]() photo credit: TheTruthAbout…

photo credit: TheTruthAbout…

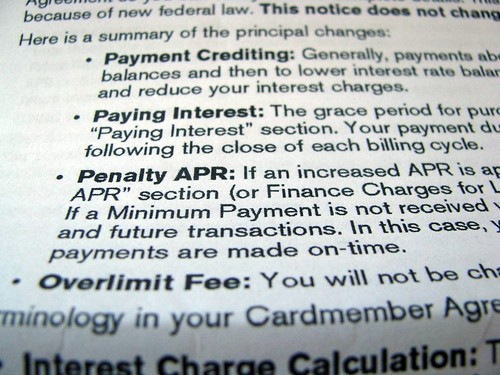

Did you know that making your minimum credit care payment every month will take you as much as four times longer to get rid of debt than making a fixed payment? I recently ran across a nifty calculator at Bankrate.com that I recommend looking at. When I plugged in $5,000 debt at 12% interest with a minimum payment of $100 I was shocked to learn that this $5,000 was going to take 259 months to pay off! The same numbers on my financial calculator showed only 70 months for a pay off. “OK”, I muttered, “What goes?”

Question: Obviously, something was haywire, but what was it?

Answer: I didn’t understand how minimum payments are figured.

Explanation: The minimum payment decreases as the payoff amount decreases.

In the scenario I tried, the minimum payment was based on the interest owed for that month plus 1% of the payoff. For the $5,000 debt, the interest for the month 1% (1/12 of 12%), or $50 and of course the 1% of the payoff is also $50 for a total minimum payment of $100 the first month.

The Minimum Payment Strategy

Now: follow along with me, for this becomes a bit diabolical: using this same formula (the interest plus 1% of the payoff), the minimum payment the following month becomes $99. As the payoff becomes less, the minimum payment continues to likewise decrease, thus stretching the debt for years and years. The 259 months (21 years and 7 months) is based on never borrowing any more money and never being late on a payment. Of course either of these events will lengthen the payoff even more.

The calculator gives different choices for calculating a minimum payment, but they are all based on the same premise: the minimum payment decreases as the balance decreases, thus keeping the borrower in the grips of the credit card company for years more than needed. I should point out that all credit card companies do not figure their minimum payments the same way. This post at Credit Card Chaser answers the question, “How do credit card companies figure the minimum monthly payment?”

This chart compares various minimum payment plans with fixed rate payments. All are based on $5000 debt and 12% interest rate.

|

Conclusion

The numbers are obvious. Do you want to be paying on that same credit card until your newborn is out of college? Of course not. This math is not rocket science, but it can be deceiving. The more you pay, month in and month out, the quicker your principle will drop, the less interest you pay and the faster you can get rid of your debt.

Remember: your credit card company doesn’t want you to get your debt paid off. The longer you drag it out, the more you end up paying and the greater risk of adding to the debt or being late on a payment.

Escape their tentacles by sacrificially making huge payments! If you could bump that payment to $400 a month, the debt will be gone in only 14 months. Get an extra job and pay $600 a month to see it disappear in only 9 months! You will be able to breathe knowing that the debt has lost its grip on you.

And 9 months sure beats 259 months!

Readers: Do you make minimum payments on your credit cards? Before reading this post, did you know how long it will take you to get your credit card debt paid off by making minimum payments? Are you currently attacking your credit card debt? If so, what are you doing that works? That doesn’t work?

No comments:

Post a Comment